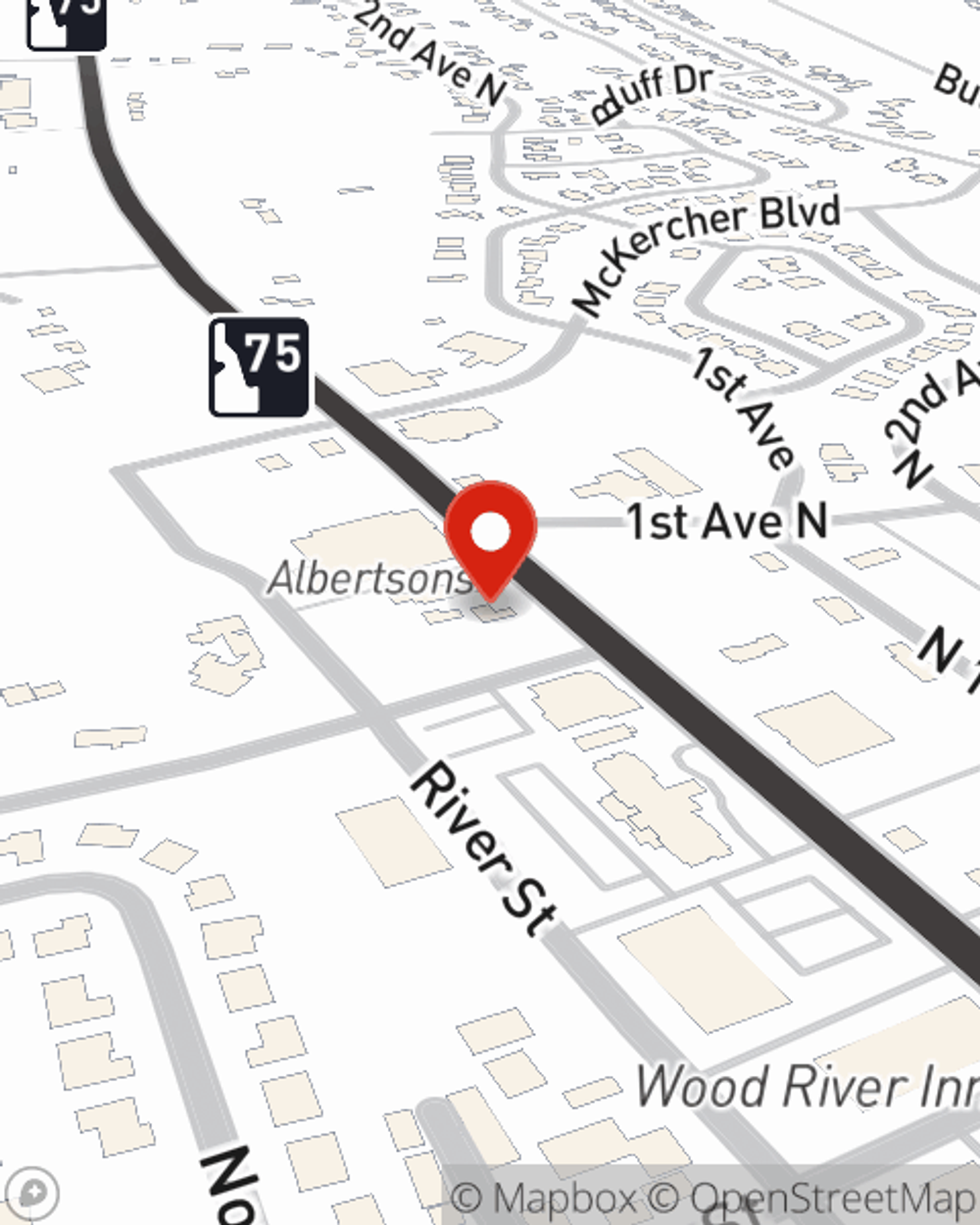

Life Insurance in and around Ketchum

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Be There For Your Loved Ones

It may make you uncomfortable to entertain ideas about when you pass away, but preparing for that day with life insurance is one of the most significant ways you can show care to your family.

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Why Ketchum Chooses State Farm

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less stressful. Life insurance provides financial support when it’s needed most. Coverage from State Farm allows time to grieve without worrying about expenses like utility bills, future savings or rent payments. You can work with State Farm Agent Patrick Buchanan to extend care for your family with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

When you and your family are insured by State Farm, you might rest easy knowing that even if something bad does happen, your loved ones may be protected. Call or go online now and find out how State Farm agent Patrick Buchanan can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Patrick at (208) 928-7888 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Patrick Buchanan

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.